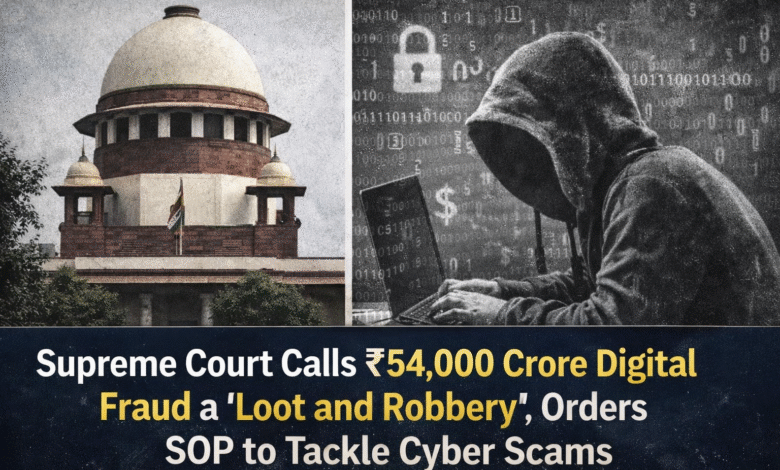

Supreme Court Calls ₹54,000 Crore Digital Fraud a ‘Loot and Robbery,’ Orders SOP to Tackle Cyber Scams

The Supreme Court on Monday described the misappropriation of nearly ₹54,000 crore through digital fraud as nothing short of “loot and robbery” and directed the Centre to frame a Standard Operating Procedure (SOP) in consultation with key stakeholders such as the RBI, banks and the Department of Telecommunications.

A Bench comprising Chief Justice Suryakant, Justice Joymalya Bagchi and Justice N.V. Anjaria expressed grave concern over the growing threat of “digital arrest” scams and said banks must play a proactive role in preventing cyber fraud. The court held that banks have a duty to alert customers about unusual and large transactions in accounts that are normally used for small withdrawals. For instance, if a retired person who typically withdraws ₹10,000–₹20,000 suddenly withdraws a very large sum, the bank should immediately issue an alert.

The Bench noted that the amount siphoned off through digital fraud is higher than the budgets of several small states and observed that such crimes may occur due to collusion or negligence of bank officials. It stressed the need for timely action by the RBI and banks.

The court directed the CBI to identify “digital arrest” cases and asked the Gujarat and Delhi governments to grant necessary sanction for investigation. It also said a practical and liberal approach should be adopted in compensating victims of digital arrest scams. The matter has been listed for further hearing after four weeks.

At the start of the hearing, Attorney General R. Venkataramani informed the court that the RBI has drafted an SOP for banks to deal with such cases, including provisions like imposing temporary debit holds on accounts to prevent cyber fraud. The court asked the Ministry of Home Affairs to consider the RBI’s SOP and issue directions for its nationwide implementation.

Senior advocate N.S. Nappinai, appearing as amicus curiae, suggested that banks should be directed to issue alerts to customers about suspicious transactions and that AI tools could be used for this purpose.

The Bench questioned why AI-driven systems did not flag suspicious activity when accounts that usually see small withdrawals suddenly register transactions of ₹50 lakh, ₹70 lakh or even ₹1 crore. The Attorney General said the RBI would examine the issue.

Coming down heavily on banks, the court observed that while banks operate in a commercial mode, they are increasingly becoming platforms—knowingly or otherwise—for rapid and seamless movement of crime proceeds. Justice Bagchi referred to a Home Ministry report stating that over ₹52,000 crore was siphoned off through cyber fraud between April 2021 and November 2025.

The Chief Justice said banks must remember they are custodians of public money and should not betray that trust. He also flagged concerns about banks lending to fraudulent entities that later end up in insolvency proceedings before the NCLT and NCLAT.

The court reiterated its earlier concerns about “digital arrest” scams, a growing form of cybercrime where fraudsters pose as officials from law enforcement, courts or government departments and intimidate victims through audio and video calls to extort money. It had earlier directed the CBI to conduct a unified, nationwide probe into such cases and asked the RBI why it was not using AI to identify and freeze mule accounts used by cybercriminals.